2000: Way back when, Apple stock was in the toilet, trading at $11 a share.

Don’t look now, but the earnings forecast that came out on Tuesday brought investors close to that same spot. On Wednesday, AAPL closed at 14-5/16. Not a pretty sight.

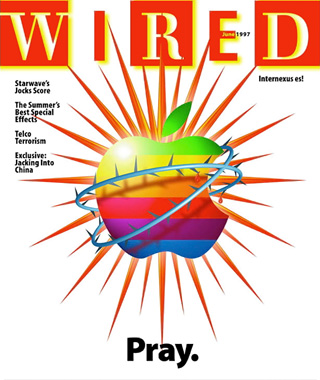

So where to from here? The last time Apple was at this point, the iMac rode out of the blue (Bondi blue, it would seem) to take the company to the top. Is there any product in the pipe now that will ratchet up the value of Apple shares and keep the “Pray” magazine covers at bay?

So where to from here? The last time Apple was at this point, the iMac rode out of the blue (Bondi blue, it would seem) to take the company to the top. Is there any product in the pipe now that will ratchet up the value of Apple shares and keep the “Pray” magazine covers at bay?

I’m certainly hoping that Apple will have something big to show consumers over the next year. I’m waiting for Mac OS X, but it looks like the latest and greatest operating system from our favorite computer maker had better be iMac-like when it’s finally introduced.

Is that a tall order? The iMac has an extremely attractive exterior that looks good on billboards, buses, commercials, and even your desk. It’s easy to touch and invites people to come on over for a look.

Unfortunately, OS X, as appealing as it is, does not have these strengths. Slap the OS on the side of a bus and it will look interesting, but I suspect that people won’t get nearly as excited about clicking on icons as they did about the sexy lines of the iMac.

For example, the BMW is a darn nice looking car. It attracts the eye and beckons you to take a lingering look. While the interior is attractive, it’s not what most people buy the car for. It’s the outside that counts in most cases. The iMac is the outside. OS X is the inside. See where I’m going?

Even if OS X is the most reliable, easiest to use, and stable OS to ever come out, people just aren’t going to get as excited about it as they would about the iMac. Relying on OS X to bring about a massive increase in sales is like BMW relying on a new interior to make the M3 a bestseller. Can you see something like that happening?

Apple, of course, has the advantage of being able to sell OS X as an individual upgrade for people who are interested. That can help the bottom line somewhat. But realistically, I can’t see OS X having a huge, immediate impact on Apple’s bottom line. In the long run, of course, things could be different. As the OS proves itself and more apps come out, Apple could start making serious inroads into the business area. That’s the long-term hope.

But for short-term action, I’m hoping Apple has an ace up its sleeve at Macworld. Place your bets now.

Further Reading

- Will Apple Stock Tank Again?, Stephen Van Esch, Mac Scope, 2000.10.02

keywords: #aapl