Like the characters in the wonderful novels by

Gabriel Garcia Marquez, Palm's Roger McNamee lives in a fantasy

world. From a March 5th

interview: "You know the beautiful thing: June 29, 2009, is the

two-year anniversary of the first shipment of the iPhone, not one of

those people will still be using an iPhone a month later."

Running Out of Cash

Palm is running out of cash. In the last quarter, Palm has run

through nearly $100 million, following a smaller loss the previous

quarter. According to the

8-K filed with the SEC on March 3 giving preliminary results for

the quarter ending Feb 27, it only has left $215 to $220 million in

cash and cash equivalents.

Palm expects to launch the Prē before the end of June, which

suggests another $100 million to cover day-to-day operations even if

the Treo and Centro keep selling at current rates. However, it "expects

declining revenues and continued margin pressure from its legacy

product lines in the fiscal fourth quarter", so it's cash needs could

be significantly greater.

Palm then has to cover the Prē launch costs.

Raising New Funds

Palm believes it has enough cash on hand, but the 8-K also says that

it is looking to raise money. The problem is how. The shares are over

$6 and, provided they can be sold over $3.25, Palm can sell part of

the shares due to Elevation Partners and keep the profit. At $6,

this would raise at most $50 million - 6-7 weeks cash at current burn

rates. Under today's (March 10) filing, Palm is looking to sell enough

shares to raise $83.9 million (or $103.6 million if the underwriters

take up their option).

But in this market, who will buy new shares in a company whose days

look to be numbered?

If this share issue fails, where will Palm go to raise money? Even

in good times, issuing bonds would be difficult and expensive when

Standard & Poor rate Palm as

8 levels below investment grade, with further downgrades

likely.

Palm's major shareholder, Elevation Partners, a venture capital

organisation, already holds 39% of the shares and is probably brushing

against the limits of investment mandates, which typically restrict how

much of the fund can be put into a single company. So new money from

Elevation looks unlikely.

Selling the patent portfolio is always possible, but with a

desperate seller, in times like these, will that even go for $50

million? In 2002, SGI sold it's extensive core graphics patents to

Microsoft for just $62.5 million.

Sprint is hoping the launch of the Prē will reverse or at least

stop its loss of customers while the carrier has an exclusive. However,

since Sprint has lost a total of $650 million over the last six

quarters, money is unlikely to come from that direction unless the

Prē is a proven winner.

Costly Production

Even if Palm staggers to the start line with the Prē, it faces

real issues with component pricing and availability and cash flow

during the ramp up of production. For suppliers, this is not like

dealing with Apple, where they know there is $28 billion available, so

they will be paid no matter what.

As Palm can not commit to and pay for a long production run, all

Prē custom components will be priced on more expensive short runs,

and suppliers are likely to insist on immediate payment or prepayment,

as will the contract manufacturer for the handset. If the Prē

doesn't sell out immediately, suppliers may commit the production

capacity to another customer, leaving Palm unable to fulfill an order

quickly. With a commodity component like NAND memory, where Apple can

lock in low prices for all likely future needs, Palm will have to pay

close to the market price.

An 8 GB Prē will be more expensive to produce than an 8 GB

iPhone. If AT&T drops the starter iPhone price to $99 or $0 +

contract, and with the development of the iPhone/iPod touch range

discussed in the previous two articles (ARM Netbooks Could Make OS X the Mobile

OS to Rule Them All and High Def iPhone and iPod touch Could

Make OS X the Mobile OS to Rule them All), will Palm be able to

match pricing and still make a profit?

Competition for Developers

How will Palm attract enough developers?

The iPhone, RIM, and Nokia all have strongly established user bases

with online stores available now, and open source developers will stay

with Android. For many people looking at buying smartphones, the phone

is as much about what other useful software is available as how good

the handset is.

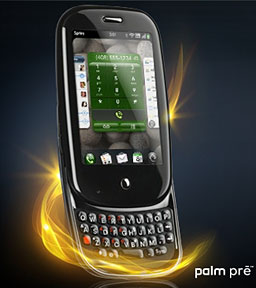

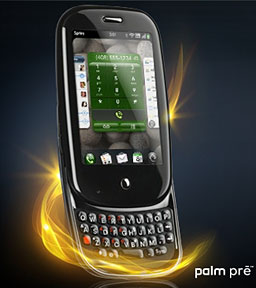

The Palm Prē and WebOS may well be better than the iPhone in

certain ways, but without good third party software to exploit those

advantages, the Prē is another feature phone trying to sell at a

smartphone price.

It looks like the only hope is to gain some early traction with the

Prē and then sell Palm to another company that needs an up-to-date

mobile OS now. If Apple doesn't launch a patent action in the courts,

the obvious possibilities include Microsoft or Sony-Ericsson to use

WebOS as a much better replacement for Windows Mobile (and possibly

it's Symbian line) and to open up the US market - or perhaps a

manufacturer such as HTC, which has made over 80% of the Windows Mobile

cellphones.

Given Palm's situation, acquiring it shouldn't cost too much.