Steve Jobs believes in the Wayne Gretzky dictum about skating to

where the puck will be, not where it's been.

Verizon would have made a great launch partner for the iPhone, but

it passed, and Verizon has been left behind. Every quarter the iPhone

adds to the AT&T customer base, and every quarter someone talks up

the end of the AT&T exclusive in the US.

Undoubtedly this benefits Verizon, as it reduces

defections to AT&T. Why move if the iPhone is coming anyway?

Limited Growth Potential

The latest so-called

cost benefit analysis by Christopher Larsen of Piper Jaffray

suggests that Apple could gain 4.6 million sales by allowing Verizon

and Sprint to sell iPhones, and it would only cost $50 of AT&T

subsidy and around $25 in extra development costs per cellphone. After

all, the iPhone market share in France rose from 15% to 40% in the 6

months after the end of exclusivity, so it should happen in the US

too.

This ignores the fact that all the networks in France are GSM. As soon as the courts ruled

against the long term agreement with Orange, all Apple had to do was

sort out contracts with SFR and Bouygues, and then let them get on with

the marketing war.

If the AT&T exclusive ended tomorrow, the only beneficiary would

be T-Mobile, the only major carrier besides AT&T that uses GSM.

Even if T-Mobile sells 1 million extra iPhones a year, that is as many

iPhones as G1s sold. Based on the above figures, Apple would lose

out.

The average carrier price for an iPhone last quarter was slightly

over $600 (Apple analyst conference call). With a 60% margin, the extra

gross profit through T-Mobile would be $360 million, but, according to

the Piper Jaffray figures, Apple would lose $50 per handset from

AT&T. In just the last quarter AT&T activated 3.2 million

iPhones, which would have cost Apple $160 million of the "extra"

profit.

The Problem: CDMA

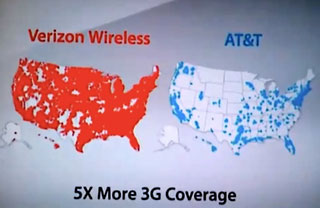

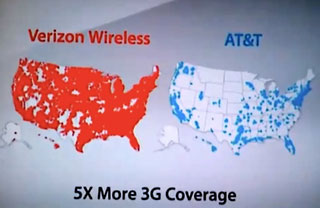

3G coverage? Verizon has a map for that!

So the whole reason for ending the AT&T exclusive has to be

moving on to the Verizon and Sprint CDMA networks, and these are

networks that both carriers are busy transitioning away from because

they recognise that they are not competitive for the future.

Verizon, to its credit, seems to recognize that it is now second

choice for smartphone manufacturers. It will start rolling out its

LTE

network in major markets next year and has accelerated this program so

it can offer much more and faster data downloads. However, it will be

at least a couple of years before enough is in place to offer a home

for future iPhones - and even then voice will still use the CDMA

network, which will complicate background processing of apps until VoIP

becomes the standard for calls.

Sprint is going the WiMAX route through ClearWire

while trying to hold on to as much of its customer base as possible and

come back from its streak of quarterly losses.

The iPhone Is a World Phone

Apart from the network issues, for the iPhone to be really

successful on Verizon and Sprint and sell the 4.6 million Piper Jaffray

suggests, Apple will need to duplicate the customer experience of the

current and future GSM models. So the CDMA iPhone will need to be a

world phone - but packed into the same iPhone shell so that all the

third party cases and add-ons fit.

This means that Apple Engineering would need to find a way of adding

CDMA electronics to the current GSM electronics in the already packed

iPhone while not affecting the battery life or the placement of any of

the controls, USB, etc. When all the extra support costs are added in,

making and selling a CDMA/GSM model for at most a few years doesn't

seem that attractive compared to other opportunities, such as a model

for China Mobile's 400 million+ subscribers.

The end of the AT&T exclusive isn't going to happen in the

States unless Congress mandates limited agreements to the benefit of

T-Mobile, or if Apple sees a real advantage in moving on because

AT&T tries to reduce the subsidies.

In effect, the US and iPhone suffer from the CDMA/GSM divide, which

the FCC will try to avoid in the next generation of mobile technology.

Meanwhile, in other countries (like Germany and Spain) Apple will be

eager to move onto other GSM networks and reproduce the French gains as

soon as the exclusive agreements end.

Verizon's Opportunity

Nevertheless, there is one huge opportunity for a Verizon-Apple

agreement: A future iTablet or

ARM based netbook with G3 support would be a great way for Verizon

to sell the benefits of its LTE network. This agreement would give

Apple a good launch partner for a product that it would want to sell

through the European operators to displace Windows netbooks and end

Microsoft's mobile dream.