Every quarter, at least one analyst suggests that Apple is about to

move to Verizon - and that the great incentive is the additional iPhone

sales.

In the March quarter, with a 131% year-over-year increase and a

record quarter for iPhone sales, Apple showed that it can do very well

without Verizon.

Verizon's Gamble

Verizon's gamble is that its network and customer base is so

attractive that Apple would have to agree to terms and make a special

CDMA

iPhone (the iPhone has always been a GSM device). Instead, Verizon is

having to pour money into its next generation LTE network far faster

than originally planned while watching AT&T's average revenue per

user increase and churn rate decrease because of the iPhone.

In other words, the iPhone effect is more powerful than the network

effect, and Verizon is having to fund its network improvements from

customers who pay less.

Little Incentive for Apple

With the latest figures from AT&T, it is obvious that there is

little incentive for Apple to add Verizon to the list of iPhone

carriers until Verizon can support the standard GSM iPhone.

Last quarter, the iPhone attracted more than twice as many net new

postpaid contract customers to AT&T as the heavily promoted Droid

and all of the other offerings did to Verizon. If Verizon had gone the

route of the Canadian CDMA carriers, such as Telus, and installed

network wide HSDPA

7.2, it might have had the iPhone when the exclusive period of Apple's

contract with AT&T ended.

Although Verizon's standard line now seems to be "it's up to Apple",

it would take some strong financial incentives to move Apple fast -

like say the 5 million WiFi-free iPhones China Unicom is said

to have agreed to buy over three years.

The iPad Factor

As Verizon doesn't yet have a competitive iPad 3G service offering,

this seems unlikely. It would be so easy, in marketing terms, to put

together an offer like AT&T's, where customers only commit for a

month at a time. What a great way to let them experience just how good

the Verizon network is!

Or maybe that's the problem, as Verizon has about half the WiFi

hotspots of AT&T and needs to have enough of the LTE network

in place to be competitive. The earliest this looks likely is the

holiday quarter this year, and Verizon is between a rock and a hard

place. Either it offers an iPad package by Christmas and risks being

shown up in all the areas where there is no LTE coverage, or it gifts

to its main competitor all the users of this year's hot Christmas

present.

iPhone Optimized for GSM and WiFi

The critical decision for Verizon was Apple taking the iPhone

processor design in-house. Apple has recognised that crucial factors

for taking over the mobile market are speed, screen (resolution and

viewing angle), and battery life. To get the latter as long as

possible, the A4 design is optimised for GSM and WiFi.

Then there are the costs of supporting a world phone that works on

both CDMA and GSM. Unless Apple chose to go with a GSM model and a

worldphone model, which would complicate technical support through

Apple Retail, it would end up paying substantial royalties to Qualcomm

on every iPhone with CDMA.

Then there is the issue of mutitasking, which will be in iPhone OS

4.0, as CDMA does not allow phone calls and data download at the same

time. So, for instance, if you're talking in the car, you still want

the iPhone navigation system to keep working and alerts like speed

traps to keep coming in. This all makes supporting Verizon and Sprint

on CDMA, an old technology standard that both companies are moving away

from, a luxury that Apple has chosen not to afford, because of how it

impacts the iPhone difference for other markets.

Looking for a Better Network

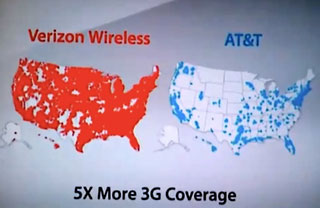

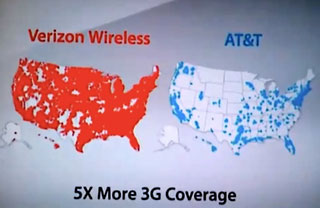

Although surveys seem to show that users want to move from AT&T,

what they want is everything they love about the iPhone on a better

network, a network where there are no dropped calls and high speed

downloading is always available - the usual nirvana. Comparing the good

reports from this year's

SXSW in Austin with last year's, when few were able to use their

iPhone consistently before the last day, it is clear that AT&T's

network investment is working and that the Verizon advantage can be

reduced.

Those who want freedom for the iPhone don't want freedom for the

carriers to give you what they want. This is the Android problem that

Google is struggling against with the Nexus One. When there is little

incentive to update you and keep your cellphone working as well as

possible, the carriers won't. After all, they have your contract for 18

months or two years, and they have new cellphones to sell.

Unless Google can solve this, Android will become the brand for

those who like to control as much as possible of their cellphone, who

want to search around the Web for the latest software and mods, while

Apple continues to expand its sweetspot - selling to people who want

their electronics to just work.

Better Markets than Verizon

Even if Apple suddenly - and against all its history - feels the

need to expand the brand so customers look on the iPhone experience as

being partly carrier dependent, there are more attractive partners than

Verizon. China Mobile has over 500 million users and, according to a

Kathryn Huberty (Morgan Stanley) reseach note, there are 50 million

Chinese who could buy an iPhone. DoCoMo still dominates the Japanese

market and, given KT's fast start with over 500,000 sold, Korea too

looks interesting.

These are all markets where the carriers want to work with Apple if

the iPhone economics works for them. These are all markets where the

carriers haven't spent much time and money trying to trash the iPhone

and then promoting their in-house premium brand Droid against it.

iPhone vs. Droid

How would Verizon promote the iPhone, now that it has Droid? Having

all those outlets available for the iPhone is a lot less interesting if

the iPhone is buried at the back of the store. It would be a return to

the old days of shopping for a Mac among racks of PCs and dealing with

staff who are motivated to sell you something else.

Further, Verizon won't want to drop Droid after investing over $100

million in advertising when it can use the Droid brand to sell millions

of handsets and has the opportunity of being this quarter's vendor to

play the various Android manufacturers (members of the Open Handset

Alliance include Acer, ASUSTek, Ericsson, Garmin, HTC, Huawei, LG,

Motorola, Samsung, Sony Ericsson, Toshiba, and ZTE) against each other.

Unless it fails, Android is likely to become the Verizon house brand

sold by preference in all of its outlets.

A Change of Management at Verizon?

It may take a change of management at Verizon for there to be an

iPhone future, in the same way that it took a change of management at

Disney for Pixar to stay there.

Vodaphone,

which already owns 45% of Verizon, has talked about buying the rest.

Like Verizon, it initially missed out on the iPhone. Realising this was

a mistake, it became the third iPhone carrier in the UK. Vodaphone

launched the iPhone in January and sold 100,000 to its customer base of

around 19 million in the first week - sales figures Google would have

loved for the Nexus One on T-Mobile.

Vodaphone knows the benefits of having the iPhone and has a good

idea of how badly not having it is affecting Verizon's business.

Verizon as a Negative Example

In any case, Apple gains from having Verizon as an example of what

happens if you don't seize the Apple opportunity when

Steve Jobs offers it to you. Since the launch of the iPhone,

AT&T has outgrown Verizon quarter by quarter. Verizon had to

buy

another carrier (Alltel) to get out in front with subscriber

numbers. Last quarter, AT&T took another half-million subscribers

off that lead after 900,000 new customers came for the iPhone.

If Apple sells around 2 million iPads this quarter, that

alone could cut another 1 million from Verizon's shrinking lead. Every

time a new iPad user tries out AT&T and gets good service for a

month, he will think all

the negative noise about size of the network is just noise and be

ready to move when the cellphone contract is over. This could boost

subscriber numbers quickly.

If Apple sells around 2 million iPads this quarter, that

alone could cut another 1 million from Verizon's shrinking lead. Every

time a new iPad user tries out AT&T and gets good service for a

month, he will think all

the negative noise about size of the network is just noise and be

ready to move when the cellphone contract is over. This could boost

subscriber numbers quickly.

By the time Verizon's LTE is truly ready, AT&T could be ahead

again.

Verizon Gives AT&T Incentive to Improve

Verizon is still useful to Apple though - it gives AT&T an

incentive to improve its network, and the better AT&T's network,

the more iPhones Apple sells. It stops Apple from being subjected to

the monopolist slowdown when it wants to take over another company -

who knows if and when Google will be allowed

to buy AdMob - and it forces competitors' costs up, as they need to

launch and support their phones on CDMA and GSM to stand a chance of

getting traction in the market.

If Apple wants to continue its exclusive arrangement with AT&T

in the US, we can expect Apple to put forward the arguments on costs

and lack of monopoly in the smartphone market to the FCC or the Senate

subcommittee looking at handsets. It will be difficult for either body

to demand that Apple suffer damages so Verizon can regain ground lost

from making poor decisions, and since the FCC lost

the case on net neutrality, it will have problems convincing Apple

and AT&T that it has the right to regulate this area without a new

telecom bill.

The Obama administration currently has other priorities.

Growing the Market with the Next iPhone

We should see the new iPhone

in June. The anticipated two-thirds increase in processor speed alone,

with a 1 GHz A4 processor (vs. 600 MHz in the iPhone 3G), will

fill the lines outside the Apple Stores on Day 1. Adding in the better

battery life and better resolution, it should be another record iPhone

quarter, if Apple can launch early enough and ramp up the production

fast enough.

Further Reading

If Apple sells around 2 million iPads this quarter, that

alone could cut another 1 million from Verizon's shrinking lead. Every

time a new iPad user tries out AT&T and gets good service for a

month, he will think all

If Apple sells around 2 million iPads this quarter, that

alone could cut another 1 million from Verizon's shrinking lead. Every

time a new iPad user tries out AT&T and gets good service for a

month, he will think all